The Tamil Nadu government has announced that it will bear the GST charges for Members of the Legislative Assembly Constituency Development Scheme (MLACDS) funds. This move aims to ensure that the funds allocated for the development of constituencies are utilized effectively without any deductions due to GST. The decision was welcomed by MLAs across party lines, who appreciated the government’s initiative to support the development activities in their respective constituencies. The MLACDS funds are crucial for the implementation of various development projects, including infrastructure development, healthcare facilities, education initiatives, and other welfare programs. By exempting GST charges on these funds, the government is expected to enhance the impact of development activities and expedite the implementation of projects. The move is also seen as a way to empower MLAs to address the needs of their constituents more efficiently and transparently. With this announcement, MLAs can now utilize the allocated funds without any deductions, ensuring that the full amount reaches the intended beneficiaries. This development is likely to have a positive impact on the overall development scenario in Tamil Nadu and improve the quality of life for its residents. The decision reflects the government’s commitment to promoting grassroots development and empowering local representatives to drive change in their constituencies. It also underscores the importance of effective utilization of funds for sustainable development and inclusive growth. The decision to bear GST charges for MLACDS funds is expected to streamline the allocation and utilization of resources and contribute to the overall progress of Tamil Nadu.

Posted in

JUST IN

Tamil Nadu government to cover GST charges for MLA/MLC funds, easing financial burden.

In Trend

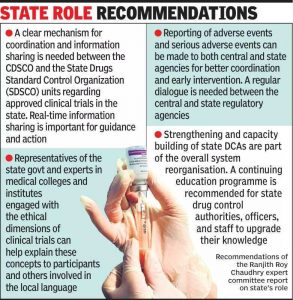

Experts stress informing states about clinical trials for improved transparency and oversight in healthcare research.