Several small finance banks in India are currently offering competitive fixed deposit rates, with some going as high as 9%. These banks provide a secure option for investors as deposits are protected by DICGC insurance up to Rs 5 lakh, instilling confidence in cautious investors. This attractive interest rate environment is beneficial for those looking to grow their savings while keeping their investments protected. It is important for individuals to explore the various options available in the market and choose the bank that best suits their financial goals and risk tolerance. By taking advantage of these high fixed deposit rates offered by small finance banks, investors can potentially earn significant returns on their investments. Additionally, with the protection provided by DICGC insurance, investors can have peace of mind knowing that their deposits are safe and secure. It is advisable for individuals to conduct thorough research and seek advice from financial experts before making any investment decisions to ensure they make informed choices that align with their financial objectives.

Posted in

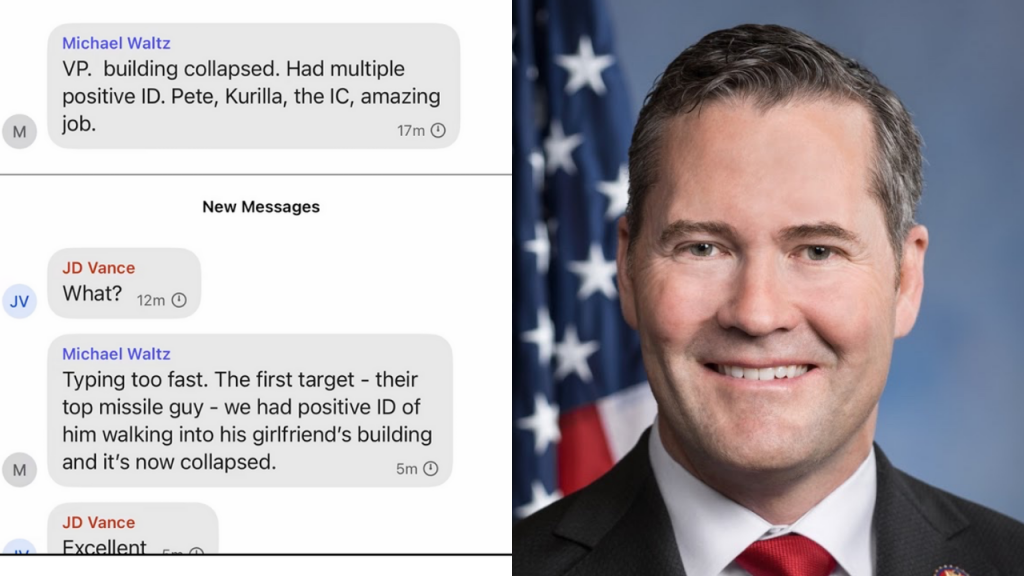

JUST IN