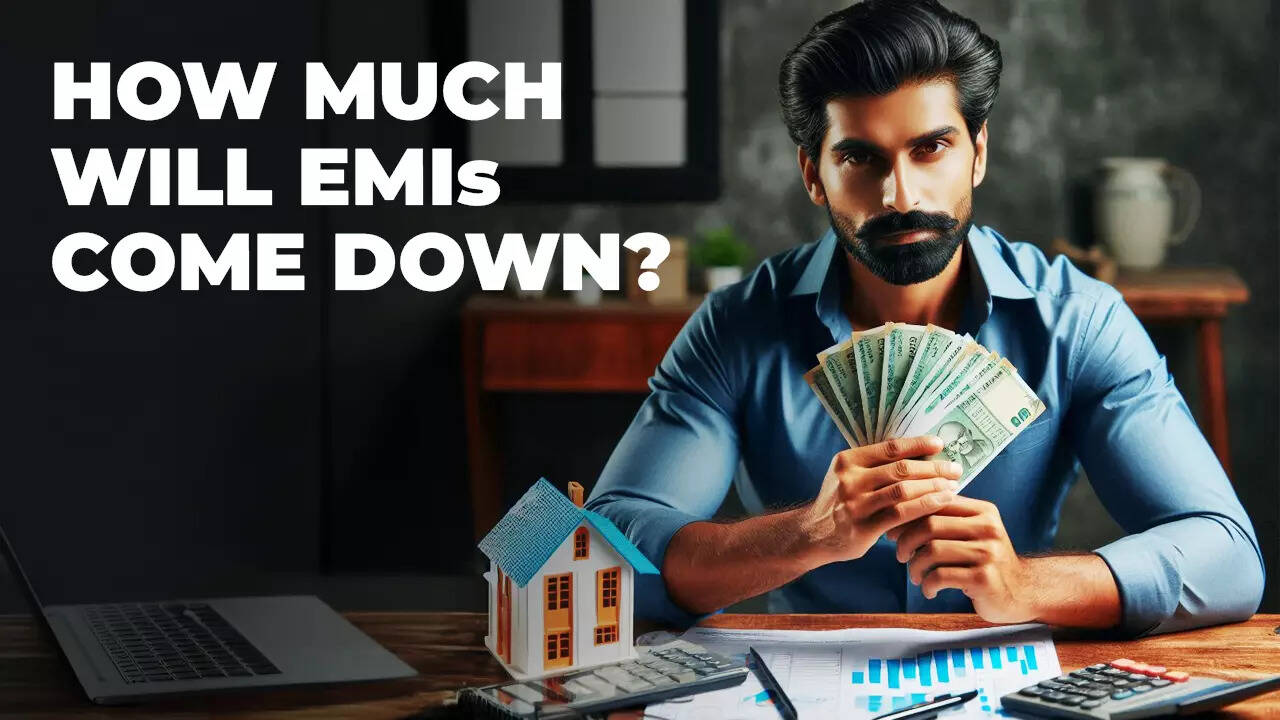

The Reserve Bank of India (RBI) has brought good news for loan borrowers in India with consecutive repo rate cuts this year. This move is expected to lead to a reduction in Equated Monthly Installments (EMIs) in the near future. The recent cuts in the repo rate by the RBI are anticipated to positively impact the borrowing costs for individuals and businesses across the country. The lowering of the repo rate, which is the rate at which the RBI lends money to commercial banks, typically results in reduced interest rates on loans such as home loans, car loans, and personal loans. This reduction in interest rates can lead to lower EMIs for borrowers, making borrowing more affordable. With the RBI’s focus on boosting economic growth and increasing liquidity in the market, these rate cuts come as a relief for borrowers burdened by high loan repayments. As borrowers eagerly await the implementation of the rate cuts by banks, experts suggest that individuals should consider renegotiating their loan terms to take advantage of the reduced interest rates. By staying informed about the latest developments in interest rates and loan offerings, borrowers can make informed decisions to manage their finances effectively. Overall, the consecutive repo rate cuts by the RBI signal a positive outlook for borrowers in India, offering them the opportunity to save on interest costs and potentially reduce their financial burden in the months to come.

Posted in

JUST IN

RBI’s Double Repo Rate Cuts Bring Hope for Lower EMIs: What Borrowers Need to Know

In Trend

US-China trade war escalates, global markets tumble, US stock futures drop, bond yields surge, recession fears rise.