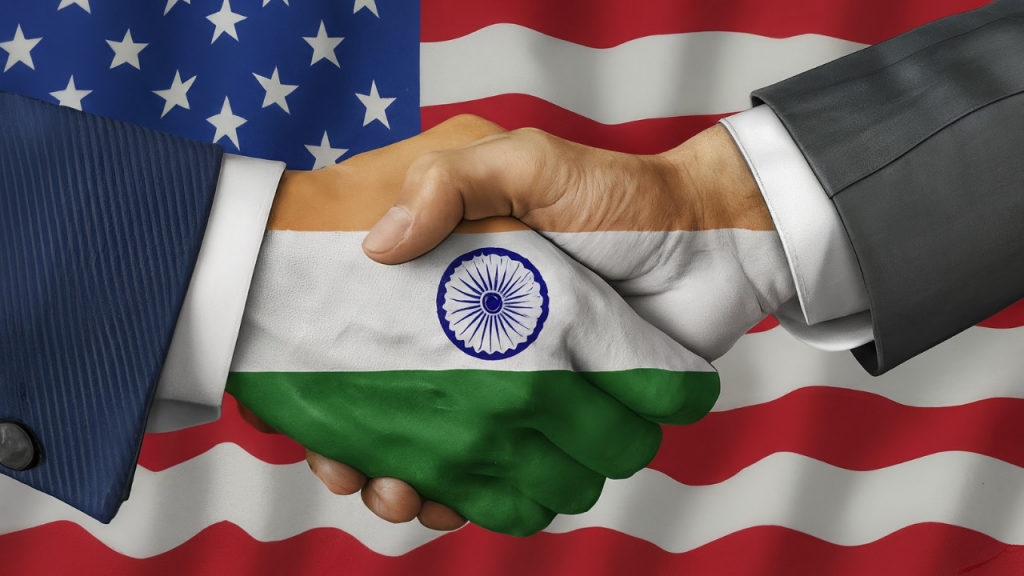

Global markets witnessed a sharp decline amidst the escalating US-China trade war, as China imposed hefty tariffs of 84% on US goods. This move resulted in a significant drop in US stock futures and a surge in bond yields, reflecting growing apprehensions about the stability of the bond market. The pharmaceutical sector bore the brunt of the turmoil, experiencing a notable decrease in stock prices as fears of an impending recession loomed large. In light of the uncertainties, investors turned towards safer investment options, causing a surge in the prices of gold and the yen, while oil prices took a plunge. The latest developments in the trade dispute between the two economic giants have sent shockwaves across global financial markets, prompting a shift in investment strategies towards more secure assets.

Posted in

JUST IN

US-China trade war escalates, global markets tumble; China imposes 84% tariffs on US goods, impacting stock futures and bond yields.

In Trend

Sebi raises asset threshold for FPI disclosure, now at Rs 50,000 crore; detailed ownership info required.