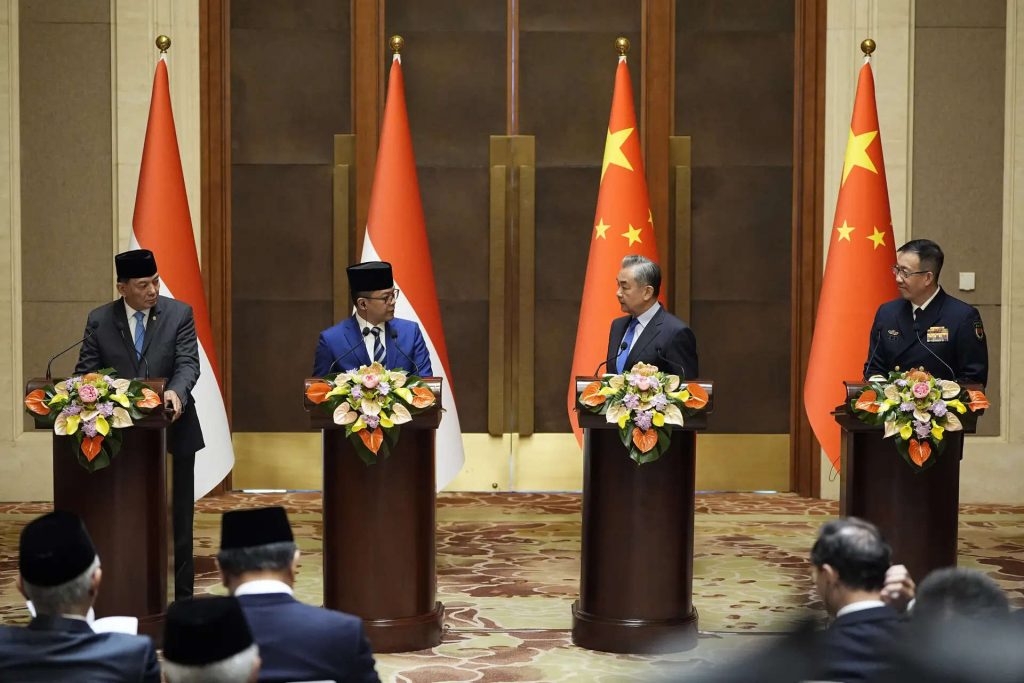

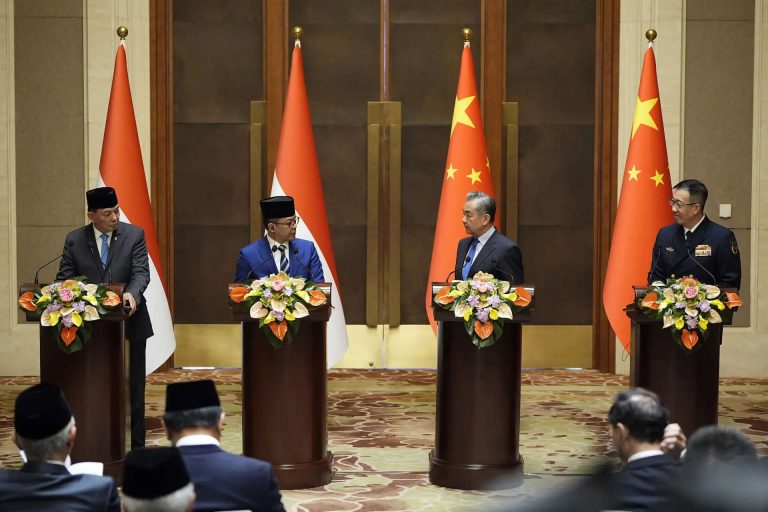

Global markets witnessed a significant decline due to the escalation of the US-China trade war, as China imposed hefty 84% tariffs on US goods. This move led to a fall in US stock futures and a surge in bond yields, indicating apprehensions about the bond market. The pharmaceutical sector took a hit with major stocks experiencing a drop, further fueling concerns about a possible recession. Investors turned to safer assets such as gold and the yen, causing a rise in their value, while oil prices saw a significant plunge. The repercussions of this trade tension between the world’s two largest economies are being felt across various sectors, raising uncertainties in the global market scenario.

Posted in

JUST IN

“US-China trade war escalates, global markets tumble; bond yields surge as recession fears rise”

In Trend

Sebi raises asset threshold for FPI disclosure, easing norms for big investors; detailed ownership info required for Rs 50,000 crore+.