In a significant development for the Indian economy, the Reserve Bank of India (RBI) has announced a reduction in the repo rate by 25 basis points to 5.15%. This move is aimed at boosting consumer spending and investments to stimulate economic growth. The repo rate is the rate at which the central bank lends money to commercial banks. A lower repo rate makes borrowing cheaper for banks, leading to reduced interest rates for consumers. The RBI’s decision comes amidst concerns over a slowdown in economic growth and subdued consumer demand. The reduction in the repo rate is expected to lower the cost of borrowing for individuals and businesses, potentially leading to increased spending and investments. This move is also likely to have a positive impact on sectors such as real estate and automobiles, which have been facing challenges due to a liquidity crunch. The RBI has also revised its GDP growth forecast for the current fiscal year downwards to 6.1% from the earlier estimate of 6.9%. The central bank has indicated that it will maintain an accommodative stance to support economic growth. Overall, the reduction in the repo rate is seen as a proactive step by the RBI to address the current economic challenges and provide a boost to the Indian economy.

Posted in

JUST IN

“Pandemic boosts online shopping: E-commerce sales surge as more consumers turn to digital platforms for purchases.”

In Trend

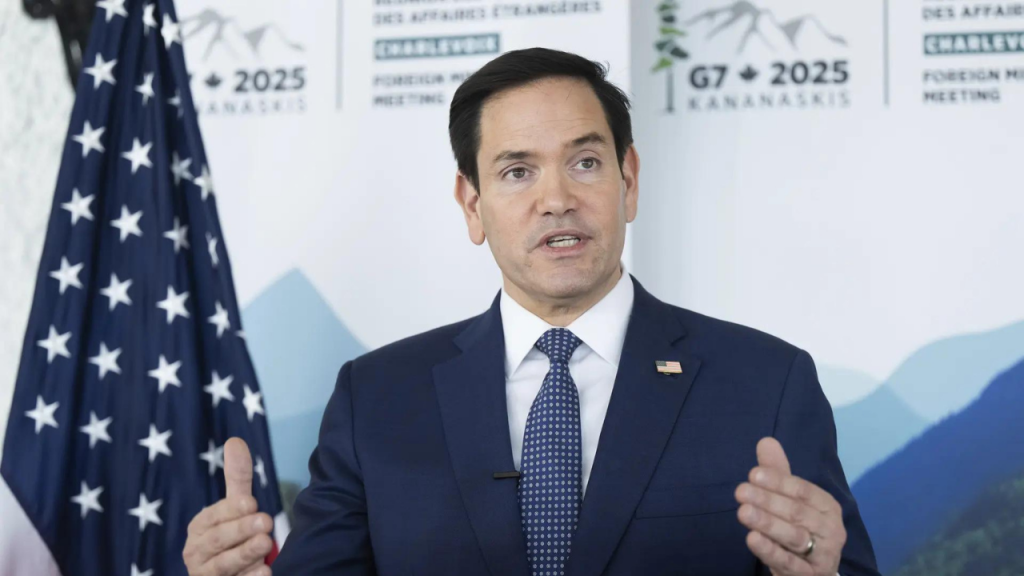

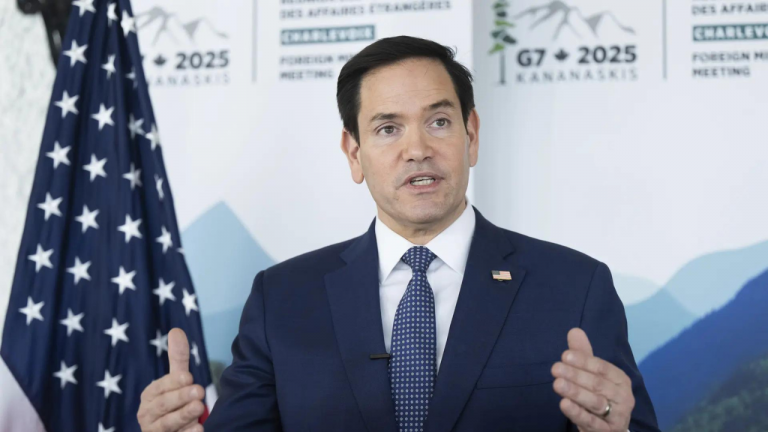

Trump justifies raising China tariffs to 125%, claims it was necessary for US trade balance: defends decision at NASCAR meet.