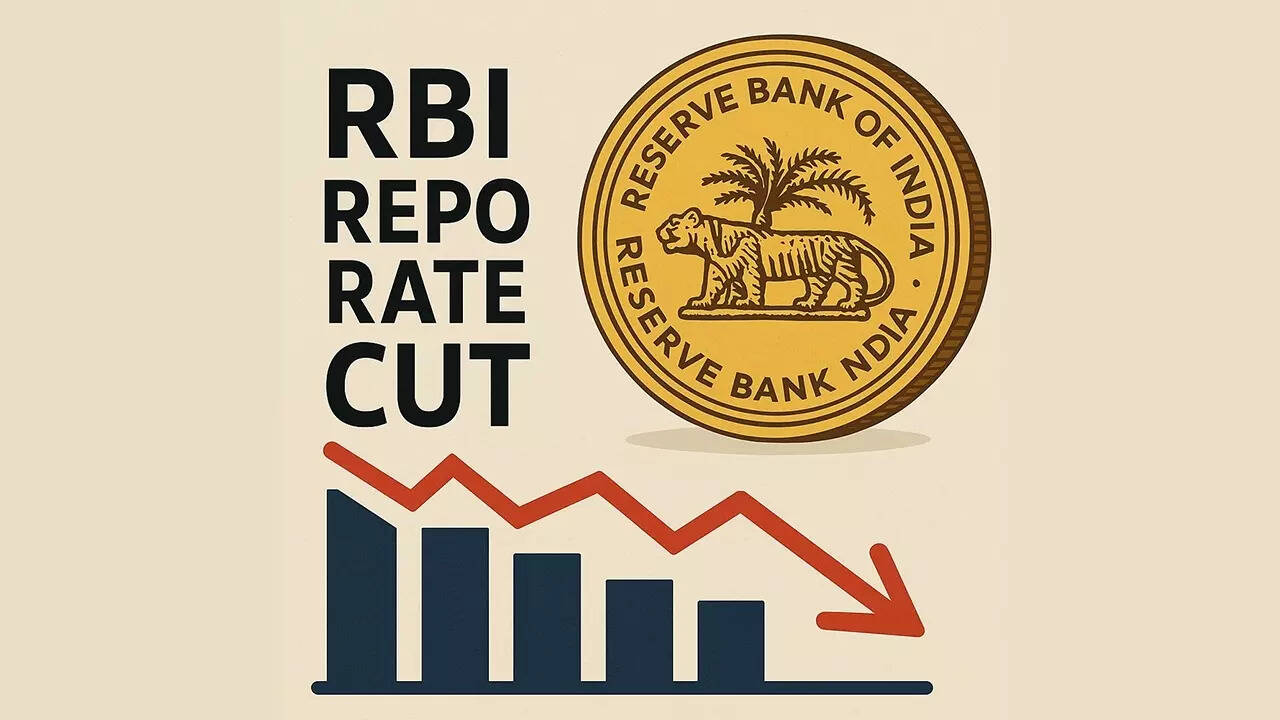

The Reserve Bank of India’s Monetary Policy Committee recently announced a 25 basis points reduction in the repo rate to 6%, along with a change in stance to accommodative in light of global economic uncertainties. The GDP growth forecast for FY 2025-26 has been marginally decreased to 6.5%, while the Consumer Price Index (CPI) inflation outlook continues to remain benign at 4%. This move by the RBI aims to stimulate economic growth and support the economy amidst challenging global economic conditions. The accommodative stance indicates a willingness to support growth while keeping inflation in check. The decision comes as a part of the RBI’s efforts to bolster economic activity and maintain price stability. The reduction in the repo rate is expected to lower borrowing costs for individuals and businesses, potentially spurring investments and consumption. Overall, the RBI’s proactive measures are aimed at navigating the Indian economy through uncertain times and ensuring a stable economic environment for growth and development in the country.

Posted in

JUST IN

RBI cuts repo rate to 6% and adopts accommodative stance amidst global economic uncertainty; GDP forecast lowered.

In Trend

“The Beacon School in Gurugram Sector 64 prioritizes real-world learning and holistic development in a modern campus.”