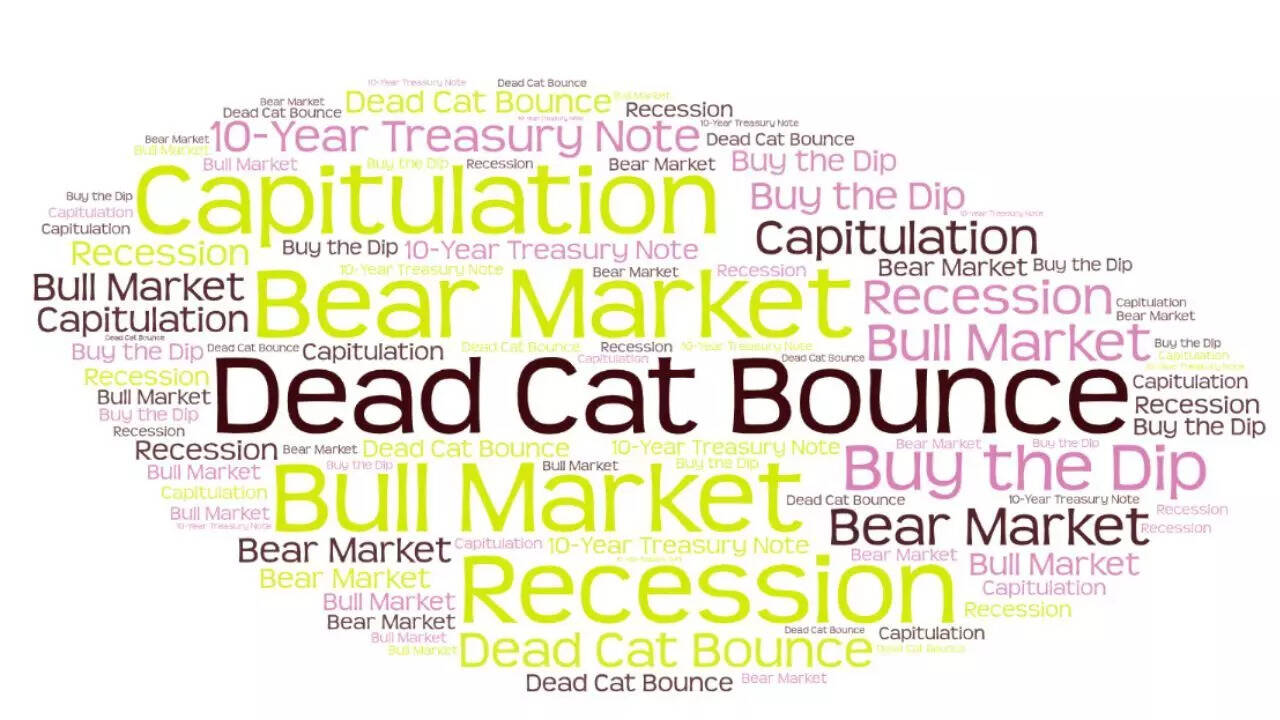

In the current economic climate in India, amidst ongoing trade tensions and market volatility, understanding financial terminology is crucial for investors. Terms like bear and bull markets, dead cat bounces, and capitulation play a vital role in reflecting investor sentiment and market trends. A bear market is characterized by declining stock prices, while a bull market sees rising prices. Dead cat bounces refer to temporary recoveries in falling markets, giving false hope to investors. Capitulation occurs when investors give up hope and sell their positions, often signaling a market bottom. Economic downturns, often signaled by recessions and shifts in treasury note yields, further complicate the investment landscape. Strategies like ‘buying the dip’, which involves purchasing assets when prices fall, are influenced by these economic indicators. It is essential for investors in India to stay informed and educated about these terms and trends to make well-informed investment decisions. Keeping a close eye on market indicators and understanding the language of finance can help navigate the complexities of the financial markets in India.

Posted in

JUST IN

Navigating Financial Jargon: From Bear to Bull Markets, Dead Cat Bounces, and Recessions Simplified

In Trend

India speeds up trade talks with US post-tariff pause, targets $500B bilateral trade by 2030 amid US-China tensions.