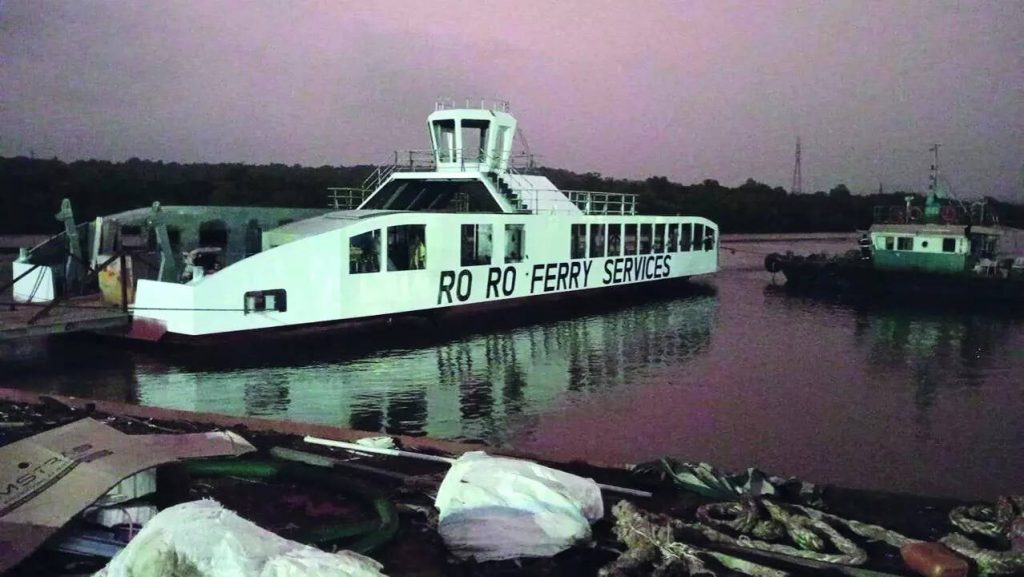

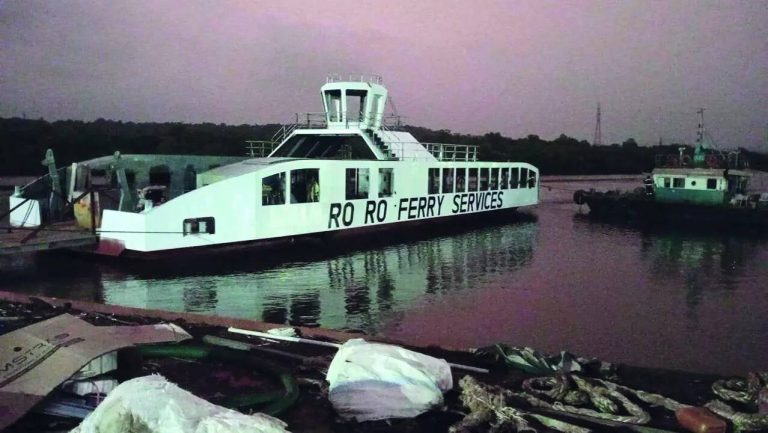

Luxury goods in India valued at over Rs 10 lakh, such as handbags, watches, art, and yachts, will now be subject to a 1% tax collected at source (TCS) starting from April 22. This new regulation, as outlined in the Finance Act 2024, is designed to bolster the income tax department’s oversight of high-value transactions by requiring the submission of PAN details. The move aims to prevent tax evasion and ensure greater transparency in the luxury goods market. The implementation of this TCS on luxury items is expected to have a significant impact on high-end retailers and consumers alike. It is crucial for individuals and businesses dealing in luxury goods to comply with this new tax regulation to avoid penalties and legal consequences. The Indian government’s decision to impose TCS on luxury goods reflects its commitment to tightening tax compliance measures and combating tax evasion in the country. Stay updated on further developments regarding this new tax policy to navigate its implications effectively.

Posted in

JUST IN

New 1% TCS on luxury goods over Rs 10 lakh from April 22 to boost tax tracking: Finance Act 2024

In Trend

Trump hints at tariff reduction in China trade war, but Beijing resists, sparking economic war fears.