In a recent development in India, the government has announced new regulations to promote digital transactions and reduce the reliance on cash. The move aims to boost the country’s digital economy and increase financial inclusion. The new rules require businesses with a turnover of more than Rs. 50 crore to offer digital payment options to customers without any additional charges. This initiative is part of the government’s efforts to create a more cashless economy and reduce the use of physical currency. It is expected to streamline transactions, reduce the circulation of black money, and promote transparency in financial dealings. The new regulations have been welcomed by many industry experts who believe that it will not only benefit businesses by reducing transaction costs but also empower consumers with more convenient payment options. The government has been actively promoting digital payments in recent years through initiatives like UPI, BHIM, and Aadhaar Pay. These efforts have already started to show results with a significant increase in the number of digital transactions across the country. With the new regulations in place, it is expected that more businesses will adopt digital payment options, further accelerating the shift towards a cashless economy in India. Experts believe that this move will have a positive impact on the economy by reducing the cost of cash management and improving overall efficiency in financial transactions.

Posted in

JUST IN

“India’s Central Vista project faces legal challenge over environmental concerns”

In Trend

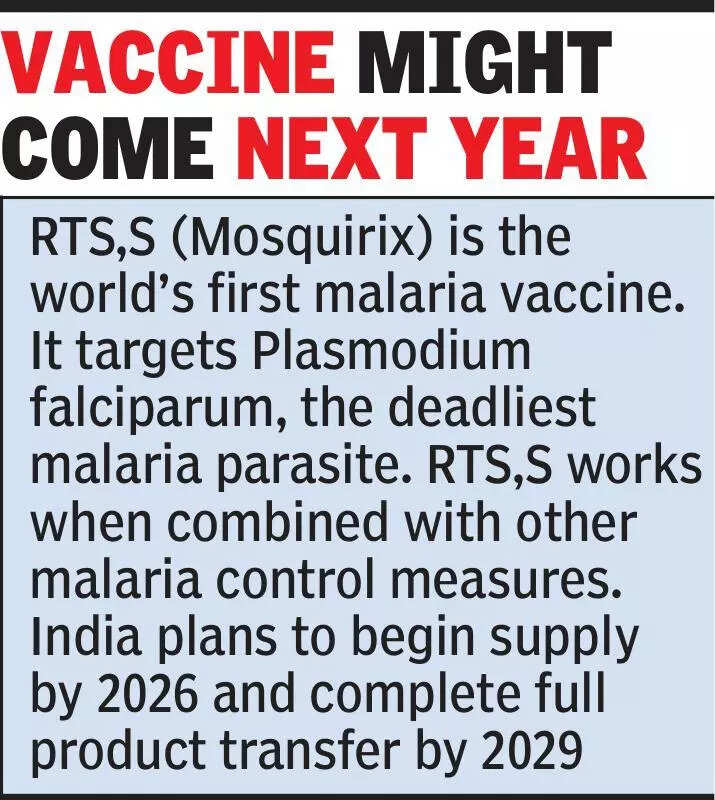

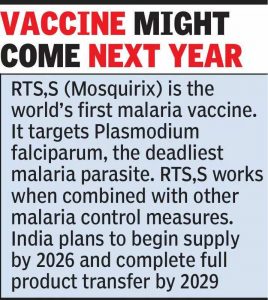

Malaria cases surge in Nagpur, Gondia district hotspot; health officials alarmed.