In recent news, the Indian government has announced significant changes in the country’s taxation system. The Goods and Services Tax (GST) Council has decided to reduce the tax rates on several items, including textiles, footwear, and electronic goods. This move is expected to provide relief to consumers and boost the economy. Additionally, the government has introduced new measures to simplify the GST filing process for small businesses. These changes aim to make the tax system more efficient and help businesses comply with regulations. The government is also focusing on promoting digital payments to reduce cash transactions and increase transparency in the economy. These initiatives are part of the government’s efforts to promote economic growth and create a more business-friendly environment in India. Experts believe that these changes will have a positive impact on the country’s economy and encourage more businesses to invest in India. Stay updated with the latest developments in India’s taxation system to ensure compliance and take advantage of new opportunities for growth.

Posted in

JUST IN

“India’s COVID-19 vaccination drive sees over 1 billion doses administered, a significant milestone in the fight against pandemic.”

In Trend

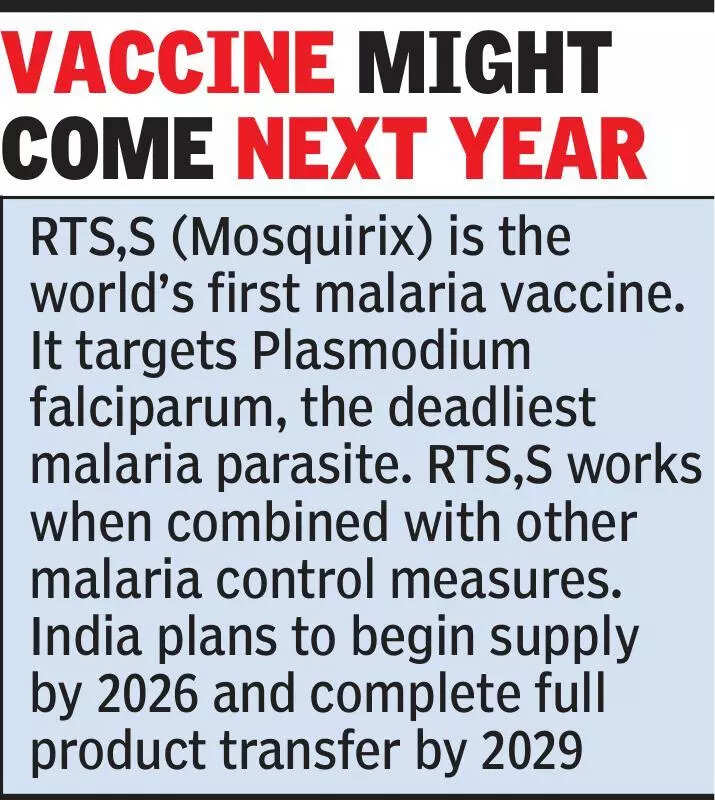

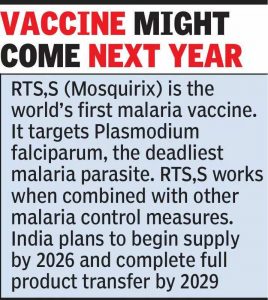

“Malaria cases on the rise in Nagpur, Gondia remains a hotspot”