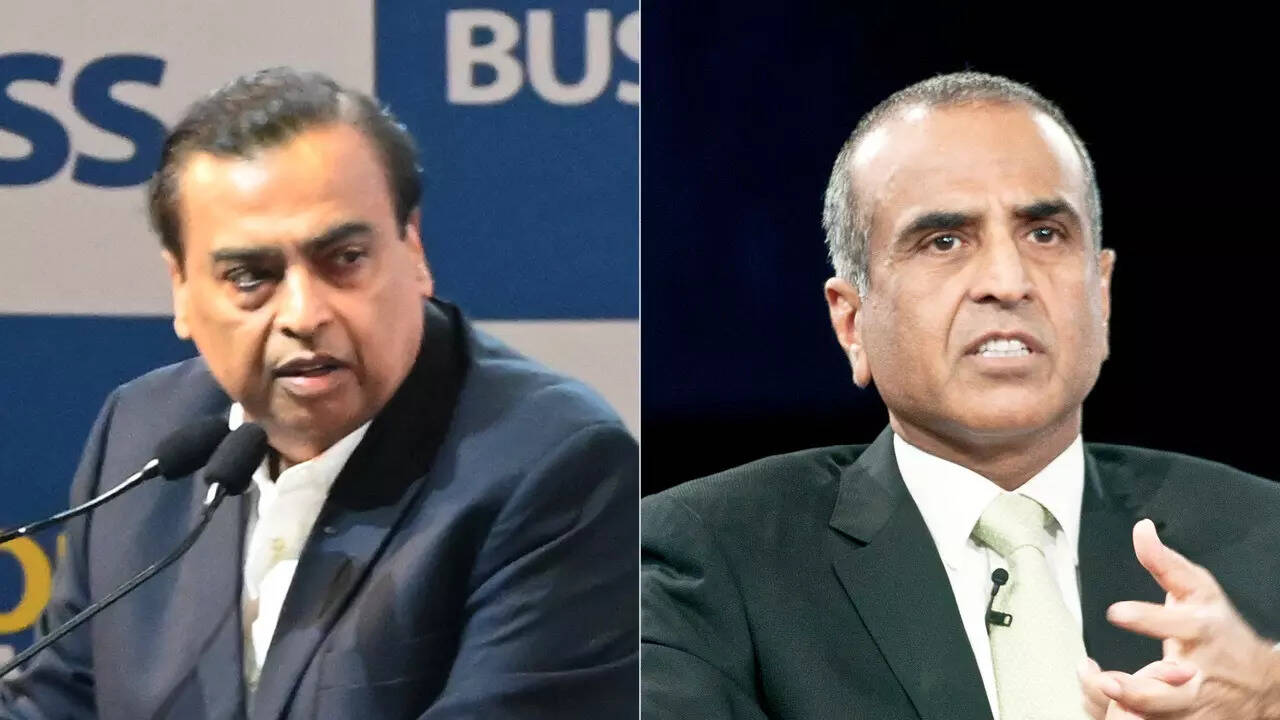

Reliance Industries, under the leadership of Mukesh Ambani, is in the race to acquire a substantial share in Haier’s Indian operations, signaling a fierce battle against a consortium led by Sunil Mittal. The move comes as Haier looks to decrease its equity and is eyeing a valuation ranging between $2-2.3 billion. This development underscores the increasing openness of Chinese companies towards collaborations with Indian counterparts. Mukesh Ambani’s Reliance Industries is known for its aggressive expansion strategies and could potentially reshape the competitive landscape in India’s consumer goods market. The potential acquisition of Haier’s Indian operations would not only bolster Reliance’s presence in the consumer electronics sector but also enhance its overall market position. Sunil Mittal’s consortium, on the other hand, is also vying for a significant stake in Haier’s Indian business, setting the stage for a heated battle between two industry giants. With the Indian consumer electronics market witnessing rapid growth and evolving consumer preferences, the stakes are high for both Reliance Industries and Sunil Mittal’s consortium. As the competition intensifies, all eyes are on the outcome of the negotiations between Haier and the potential investors. Stay tuned for more updates on this developing story.

Posted in

JUST IN

Reliance Industries vies for stake in Haier India, challenges Sunil Mittal-led consortium in $2-2.3 billion valuation bid.

In Trend

Ather Energy launches IPO to raise Rs 2,981 crore for expansion and innovation in electric two-wheeler market