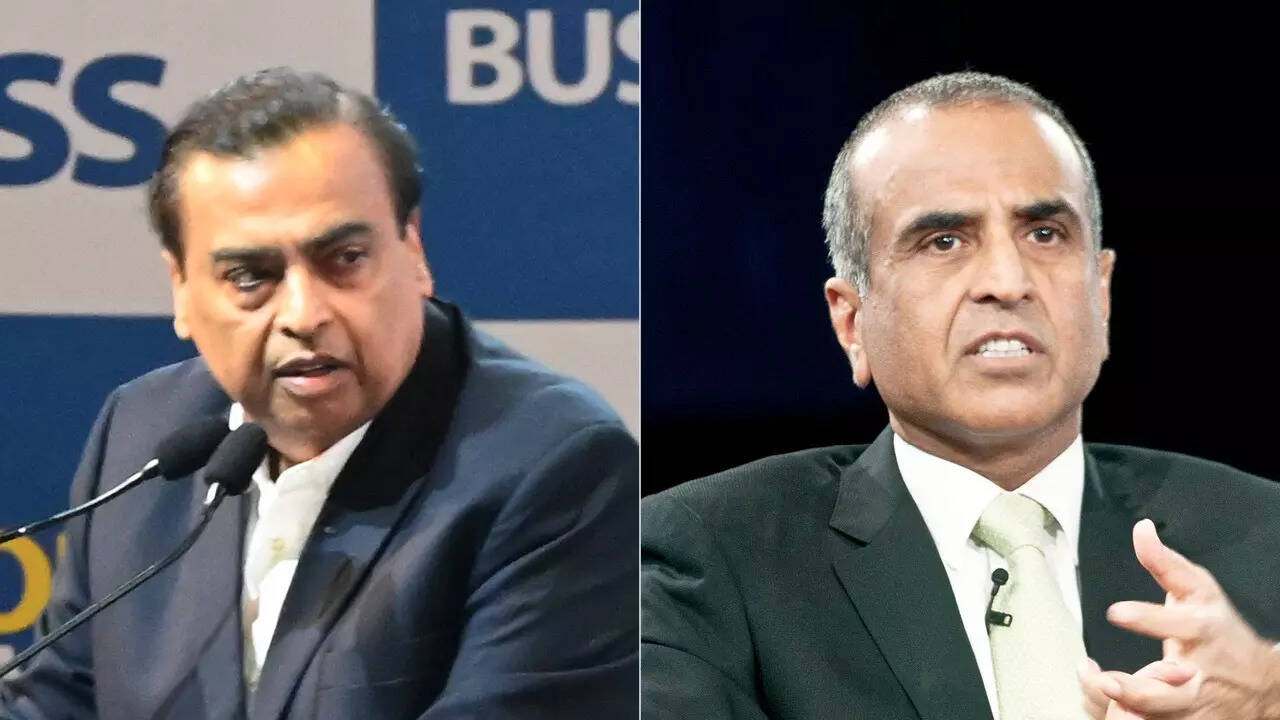

Reliance Industries, under the leadership of Mukesh Ambani, is currently in the spotlight as a potential frontrunner in the race to acquire a substantial share in Haier’s Indian operations. This move has heightened the competition with a consortium spearheaded by Sunil Mittal. The Chinese multinational corporation, Haier, is looking to decrease its equity and is eyeing a valuation ranging between $2-2.3 billion. This development comes as Chinese companies are increasingly showing interest in forming partnerships with Indian businesses. Mukesh Ambani’s Reliance Industries, a major player in various sectors including telecommunications and retail, is strategically positioning itself to expand its presence in the Indian market. The potential acquisition of a stake in Haier’s Indian operations could further solidify Reliance Industries’ foothold in the consumer electronics sector. With the Indian government’s push for self-reliance and the ‘Make in India’ initiative, partnerships between Indian and foreign companies are being encouraged. This deal could pave the way for greater collaboration between Chinese and Indian entities, leading to technological advancements and economic growth in the region. As the negotiations unfold, all eyes are on how this acquisition bid will unfold and what it could mean for the Indian consumer electronics industry. Stay tuned for more updates on this developing story.

Posted in

JUST IN

Reliance Industries vies for stake in Haier India, challenging Sunil Mittal-led consortium in $2-2.3 billion deal.

In Trend

Ather Energy’s IPO targets Rs 2,981 crore for expansion amidst positive market outlook for electric two-wheelers.